Support needed for landlords after tenants stop paying rent

Celebrating NAHREP familia, cultura, politics, and grassroots action

Que onda mi gente?!

I don’t know about you, but I’m determined to make facemasks fashionable. This week, I received several masks with beautiful Mexican embroidery from a small business in New York called Sololi. I’m kind of excited to sport these over the next few months! I’ve also been leaving the house a lot more lately and interacting with people, with facemasks on, of course. All of it is just so strange. I feel like you don’t get a full sense of a person if you can’t see their full face, you know? Given how relationship driven real estate is, what do you guys do to establish “confianza”? Do you briefly let them see your full face and smile at them at the beginning or the end of an interaction? Are you all used to it now? I don’t think I’m there yet. It all feels like a scene from The Handmaids Tale when the handmaids from D.C. wore facemasks. But, it’s the new normal and absolutely necessary. Como dicen los Españoles, “Vale y venga tios.” Let’s make the best of it and make it fashion.

It’s time to support small landlords during the pandemic

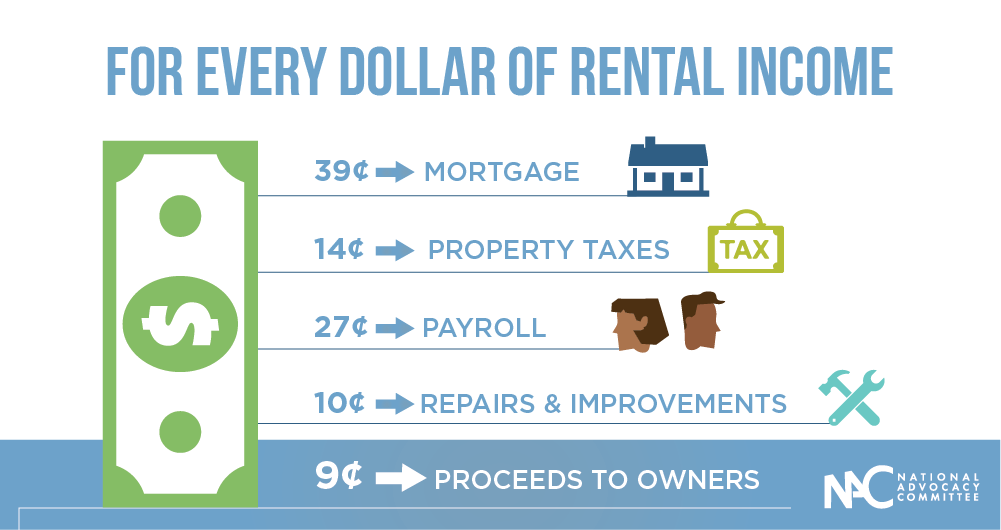

For years, at NAHREP we’ve been encouraging our members to invest in real estate and rental properties as a means to build wealth. Lately, a lot of policy conversations have revolved around rental assistance, but with little regard for landlords, who happen to also be struggling small businesses during this pandemic. According to the Washington Post, for every dollar a rental property owner gets from rent, only 9 cents go to the owner in the form of profits. The vast majority of rental income goes to mortgages, property taxes, payroll and repairs. I’m not sure policy makers and the overall public completely understands that. NAHREP Director, Nora Aguirre, offered a story that paints a picture of what folks are going through right now.

Señora Ruiz owns two rental homes, one in the city of North Las Vegas and the other in Las Vegas. For the last 30 years she has worked for Caesar’s Palace but was furloughed due to the pandemic. She has been told that she will not regain her job until 2021. While she has been receiving unemployment insurance benefits, they are not enough to cover her personal residence and her rental properties. Since both of her tenants have also been laid off, she hasn’t been receiving any rent. Señora Ruiz says that she will not be able to sustain this situation for long and might decide to put her rentals on the market to salvage the equity she has worked so hard to build over the past 15 years. Her son, who started a small business doing mechanical work, is also facing serious financial difficulties and is relying on her to help. “Everything we built feels like its tumbling down.”

Many of you have reported that some renters receiving unemployment insurance or stimulus checks have been able to make their rental payments without a problem. However, not everyone has access to benefits and for some, it’s just not enough to get by. For example, many immigrants do not qualify for any assistance, and many Latino small business owners still have not applied for the Paycheck Protection Program.

That is why we’ve teamed up with the UC Berkeley Terner Center for Housing Innovation to advocate on behalf of small landlords, like many of you. The following proposal is one that we’re pitching to Congress. If you have a relationship with your Member of Congress, please reach out to them to talk about this issue.

PROPOSAL: Congressional program for small landlords to receive funding in order to cover rental losses caused by the pandemic during the national emergency.

- Small landlords would be able to tap into existing lending programs such as the Paycheck Protection Program or a new funding source to cover lost rent payments.

- Loan limits would be equal to the difference between rents collected now versus before the pandemic, functioning like a line of credit as a long term, low interest loan.

- Smaller property owners would be prioritized under this program rather than large scale investors.

Please keep reaching out to your U.S. Senators urging them to take this issue on. This is one of the issues we included in our NAHREP Call to Action. If you are a landlord and are facing similar hardship, reach out to me at nlimon@nahrep.org and tell me your story. This is how we get things done.

Hasta la proxima familia. Los quiero mucho.

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.