2020 Presidential Campaign: Housing Part 2

Celebrating NAHREP familia, cultura, politics, and grassroots action

Qué onda mi gente?!

The Republican National Convention is happening this week and, as promised, we’re going to cover what the Trump Administration has meant for housing and homeownership. While it is not the same to compare a plan, something that we have no clue will actually get enacted, to actual actions taken by a particular administration, it is still important to understand the different philosophies and priorities of the candidates for President we have before us.

The Trump Administration’s Housing Agenda

The Trump Administration has implemented policies over the last four years, stemming from agencies such as the Department of Housing and Urban Development (HUD), Federal Housing Finance Agency (FHFA), Federal Housing Administration (FHA), and the Consumer Financial Protection Bureau (CFPB), along with support for congressional legislation. The following will break down these actions as they relate to our policy positions in the State of Hispanic Homeownership Report, in addition to COVID responses and other notable housing actions.

- Increasing Housing Inventory

- Access to affordable credit (affordable and accessible mortgages for Latinos)

- Immigration as an economic imperative

- COVID response

What about increasing housing inventory?

|

|

|

|

|

|

What about access to credit?

|

|

|

|

|

|

|

|

Side note: I do want to say that QM reform, the Capital Rule and CRA reform are all still proposed rules. Since none of these have been implemented, time will tell how much these regulations will impact Latino borrowers.

|

|

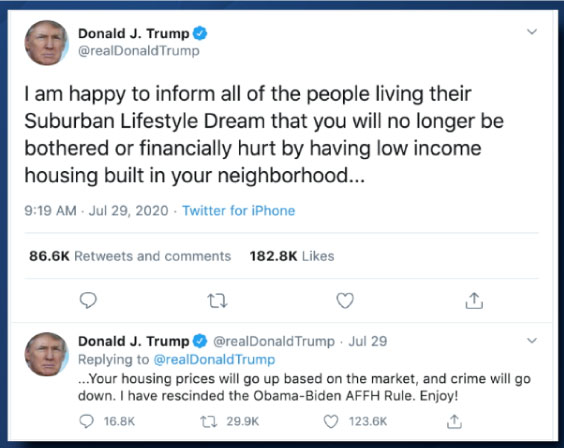

What about ending discrimination in housing and advancing minority homeownership?

|

|

|

|

|

|

What about a protecting homeowners from the impact of COVID-19?

|

|

|

|

|

|

Anything else?

|

|

|

|

We hope you found these two blogs useful familia. Now let’s have a conversation about the issues.

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.