A peak inside the House version of the HEROES Act

Celebrating NAHREP familia, cultura, politics, and grassroots action

Que onda mi gente?!

Como andamos? I am excited to welcome all of the new members to the National Advocacy Committee (NAC) and thank you to everyone who responded to our first ever national advocacy campaign last week that put our grassroots operation to work. We tried to make the process as easy as possible and we appreciate every one of you who sent the email to your Senators. The more a Member of Congress hears from their constituents on a particular issue, the more they’re likely to listen.

For those of you who are new to the NAC, bienvenidos! This is the group that makes the magic happen, the group that understands that we cannot afford to sit on the sidelines and not speak up. The future of our businesses depend on our advocacy, the future of Latino economic mobility rests on our ability to leverage the power of our organization, and the future of our country depends on our ability to ensure policy makers understand the importance of the Latino demographic to the future of our economy. Thank you for being a part of this powerful group. We are the voice of Hispanic homeownership and we get things done!

I sent my email to my U.S. Senator. Now what?

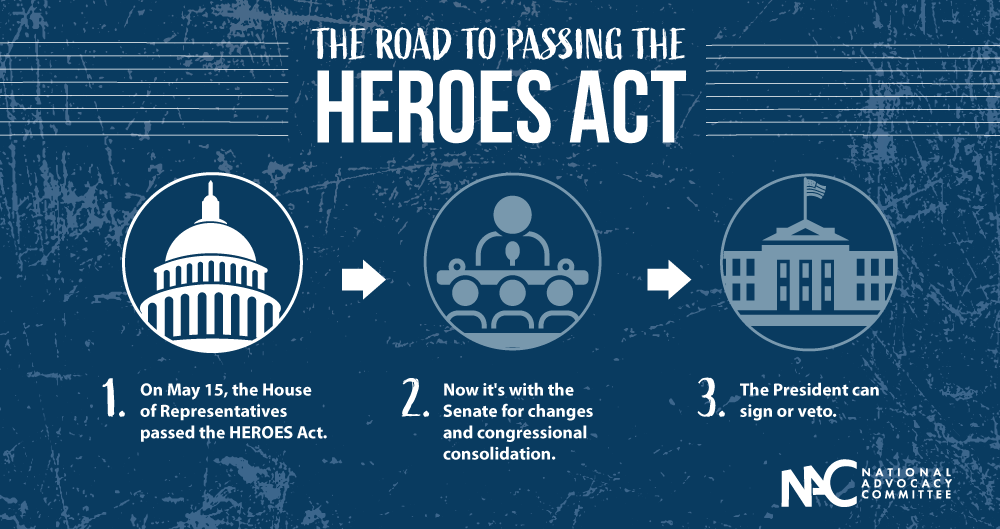

Our first national advocacy campaign (the first of many more to come) is focused on the next stimulus bill. Last Friday, the House of Representatives passed the HEROES Act, the Health and Economic Recovery Omnibus Emergency Solutions Bill. How do they even come up with these acronyms? But anyways, the House passing a bill is only the first step. The ball is now in the Senate’s court to take or leave what they want from the bill. And, it is up to us to put pressure on the Senate to ensure that the issues we care about most make it through.

Although the Senate has said that the HEROES Act is “dead on arrival”, meaning that they will not work with this version of the bill and instead will create their own, it is important to note what made it.

A brief summary of the HEROES Act:

SMALL MOM AND POP LANDLORDS

What’s in it: A lending tool for small property owners, like many in the NAHREP family, to access long-term, low-cost loans. These loans are available for residential rental property owners in order to temporarily compensate them for documented financial losses caused by reductions in rent payments.

What’s likely to happen: NAHREP has also asked that small landlords be considered small businesses and become eligible to apply for PPP loans, however we have not heard about the likelihood of this yet. This is an issue we are taking a leadership role on and we were pleased to see that support for small landlords was included in the bill. Because not many organizations are working on this issue, our advocacy will be super important here. We have seen some interest from the Senate to take this issue on. You will hear more from us on this subject as it is one of our top priorities.

EXPANDING THE PAYCHECK PROTECTION PROGRAM

What’s in it: The HEROES Act provides additional flexibilities and funding for the PPP program. All positive developments, though we will be pushing for additional guidance for independent contractors in the Senate version. The bill includes:

- Additional funding and extends the “covered period” from June 30 to December 31.

-

Extends eligibility to all 501(c) nonprofits of all sizes.

- Alleviates burdens to borrowers deemed ineligible due to prior criminal history.

- Creates a safe harbor for borrowers who cannot rehire in the prescribed timeframe.

What’s likely to happen: We just heard that Speaker Pelosi is set to pass a new bill focused only on dealing with some of the problems we experienced with the PPP since the CARES Act passed. Both the Senate and the House know this is a political sticking point so we are likely to see many of the things above included in the final bill.

KEEPING LATINO FAMILIES IN THEIR HOMES

What’s in it: The bill extends forbearance options to all mortgages, not just those that are federally-backed. It also ensures better repayment options for consumers, including simply maintaining the same payment schedule and extending the loan by the period of missed payments.

What’s likely to happen: Unclear what will happen here in the Senate. However, the House version was exactly what we asked for in our letter.

CREDIT PROTECTION DURING THE PANDEMIC

What’s in it: Negative consumer credit reporting would be suspended during the COVID-19 pandemic plus 120 days. It would also permanently ban the reporting of medical debt arising out of COVID-19 treatments.

What’s likely to happen: This is a sticky issue as it is in everyone’s interest that credit scores actually mean something. There is some movement in the Senate to ensure that there is some credit protection during the pandemic, but the Senate version will likely still include transparency in credit reporting. If people missed payments, lenders will know.

HOMEOWNER ASSISTANCE FUND

What’s in it: The bill provides $75 billion to states, territories, and tribes to address the ongoing needs of homeowners struggling to afford their housing due to COVID-19 by providing direct assistance with mortgage payments, property taxes, property insurance, utilities, and other housing related costs. NAHREP signed on to a letter in support of this fund.

What’s likely to happen: Again, it is unclear what will happen here in the Senate as this adds to the price tag of the bill. However, we do know this is a priority for some Senators.

IMMIGRANTS AND MIXED-STATUS HOUSEHOLDS

What’s in it: The bill provides additional cash payments to individuals and their dependents, including future and retroactive payments for ITIN holders and mixed-status families, correcting a flaw in the CARES Act that left out many taxpaying families. The bill also honors all essential workers, including farmworkers critical to our food supply, by providing them premium “hazard” pay. It also provides work permits for undocumented workers who work in “essential industries” such as health care, public safety, and agricultural workers.

What’s likely to happen: All of the above is unlikely to be included in the Senate version and there have already been reports stating that these provisions are why the House bill is “dead on arrival.”

ADDITIONAL CASH PAYMENTS

What’s in it: The bill issues one more round of cash payments of $1,200. Whatever amount of stimulus check you go the first round, you would get this next round. The biggest change is that all dependents will receive an extra $500, previously only dependents 17 and younger received a stimulus check.

What’s likely to happen: I believe this has a good chance of making it in the Senate bill. If so, we may see another round of stimulus checks come in.

RENTAL ASSISTANCE

What’s in it: The bill includes funding for a series of rental assistance programs, including:

- $100 billion in emergency rental assistance for renters who are lower income, but do not meet section 8 eligibility.

- $4 billion for tenant-based rental assistance which offers flexible arrangements for rent/utility/deposits subsidies for lower-income families in privately-owned apartments/homes.

- $5 billion in Community Development Block Grant funding; and $1 billion for the Community Development Financial Institutions (CDFI) Fund.

What’s likely to happen: Some sort of rental assistance will likely be included in the Senate bill, however I’m predicting at a much more reduced price tag.

STATE AND LOCAL RELIEF

What’s in it: The bill includes nearly $900 billion in funding for state and local government relief.

What’s likely to happen: This will be the heart of the negotiations. There is support for this on both sides of the aisle but it is likely to be a centerpiece of the debate. What’s important to note for us is that if we want help for immigrant workers, it will most likely come from state and local relief, not from Congress.

Moving forward

This is just the House version, mi gente, the opening act for negotiation. The fun stuff will happen over the next few weeks. Anything can happen. But, we can expect a vote by mid-June. What we do know is that the top issue for Democrats is likely to be relief for state and local governments. Additionally, Majority Leader McConnell (R-KY) and Sen. John Cornyn (R-TX) are apparently writing legislation that would exempt certain businesses from liability during the pandemic. This provision is likely to have a positive impact on NAHREP small businesses, but may be opposed by consumer groups that fear it could lead to businesses being less careful about pandemic spread.

Small businesses will also remain a focus of the next legislation. Your stories as to how you’re managing your businesses have been so important and NAHREP will continue to share them with legislators. Both sides of the aisle, Republicans and Democrats, will want to replenish funding for the PPP program and push for changes to the program’s eligibility and loan forgiveness guidelines. This is where we will focus our efforts.

Policy matters mi gente. Let’s do this.

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.