QM Patch is getting extended and replaced

Celebrating NAHREP familia, cultura, politics, and grassroots action

Que onda mi gente?!

So I’ve been doing this thing lately with my cookbooks during quarantine. I make the recipe and in the margins of the cookbook I’ll jot down whether or not I liked it along with a note about what happened that day. It can be anything from something historical happening like, “the Supreme Court ruled on DACA today”, or something silly like, “today I got a facemask tan after I spent the day outside.” I figure this will be a relic of what I leave behind whenever anyone asks me what it was like to go through 2020. Or, when I make these recipes again, I’ll come back to this year and put into perspective the little things that were actually big things and will go on to change our lives forever. So what about you? Any weird or cool COVID-19 traditions?

The QM Patch is Expiring Next Year… Who remembers that?

For those of you who attended last year’s Housing Policy & Hispanic Lending Conference in D.C. or participated on our Capitol Hill visits, you’ll remember that one of our top policy priorities has been monitoring what the Consumer Financial Protection Bureau (CFPB) decides to do about the “QM Patch” given that it is set to expire next year. Remember that? Let’s do a little refresher.

Today, the CFPB Qualified Mortgage (QM) rule provides a safe harbor for any loan that meets the CFPB’s definition of a Qualified Mortgage. Safe harbor means that if lenders met the QM guidelines to qualify a loan, then they are protected from lawsuits from borrowers claiming the lender failed to appropriately qualify a borrower’s ability to repay. Because of these protections, lenders mostly lend in the safe harbor space to avoid this liability.

Cliff notes on the current definition of QM:

Risky loan features are not permitted: Think back to loans made before the 2008 crisis: interest only, negative amortization, terms longer than 30 years, balloon payments, etc. All of these loans are not permitted under QM.

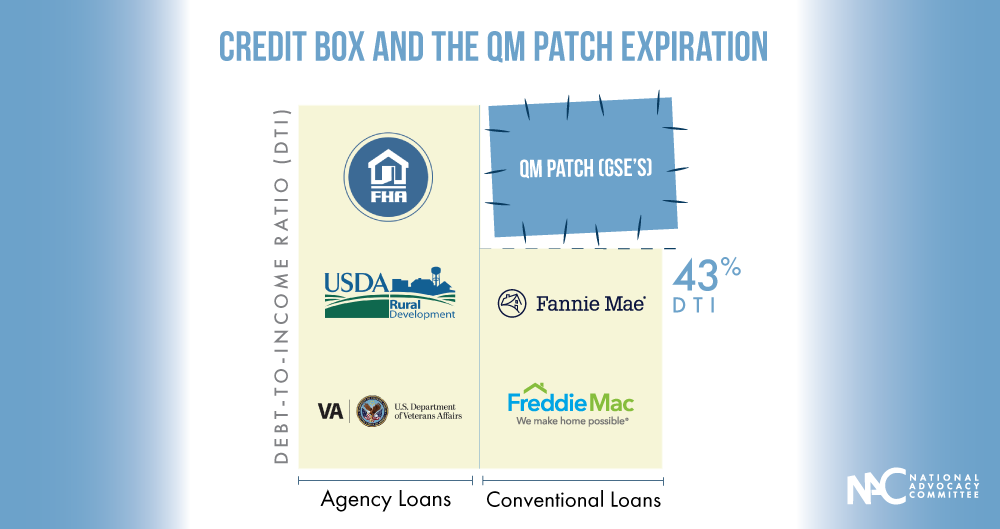

Limitation on Debt-to-Income (DTI) ratios: Borrower’s DTI ratio cannot exceed 43 percent under the current definition of QM. However, FHA, VA, and USDA loans all have a different set of rules on debt, so the DTI limitations doesn’t apply to those loans. A strict 43 percent DTI requirement for QM would decimate lending for Latino borrowers outside of the FHA space. Currently, a third of Latino borrowers have DTI over 45 percent.

Thus, the QM Patch was created: A temporary measure to eliminate the 43 percent DTI limit for loans that otherwise complied with GSE guidelines. The patch is set to expire on January 10, 2021. Meaning all GSE loans above 43 percent will no longer be considered QM loans. That’s what I call: No Bueno.

Appendix Q: This is the part of the QM rule that requires lenders to follow a list of technical requirements for how they document a mortgage applicant’s debt and income. It is complicated, hard to use, and outdated. It was literally a direct copy of old FHA guidelines, and even FHA has updated them since then! Complying with Appendix Q requirements for documentation is the most difficult for borrowers who are self-employed or work in the gig economy.

Last September, NAHREP submitted a letter urging the CFPB to use the expiration of the QM Patch as an opportunity to improve the rule in ways that could lead to more Latino borrowers getting approved for loans.

Last month, the CFPB released its proposed rule change. Let’s explore the good, the bad, and the ugly.

First the good: the rule extends the QM Patch until a new rule is implemented. The Patch will be extended until the effective date of the new rule, or the date that lenders will have to start complying with the changes. We’re hearing this won’t be before April 1st, 2021. Or, when the GSE’s exit conservatorship. But, the chances of the GSE’s exiting conservatorship before then is as likely as unicorns flying so the April timeline is likely the soonest that it will expire.

Also good, the rule eliminates both DTI requirement and Appendix Q, while protecting the restrictions on risky loan features. This is the best part of the rule. Eliminating DTI and Appendix Q as has been at the core of what we’ve been advocating for. DTI is a poor predictor of default and Appendix Q is not only outdated but one of the main reasons why it is so difficult to qualify self-employed borrowers.

QM definition moves to a pricing model. This is mostly good, but could also be ugly because of where the proposed rule draws the line on pricing. Instead of looking at DTI ratios, QM loans would be determined by the price of the loan, with the assumption that lenders will price the loan by evaluating a borrower’s risk holistically, not just by DTI.

The new rule outlines that if a loan is priced at up to 2% above the average prime interest rate, then it is considered QM. However, a loan would only be considered safe harbor if it is 1.5% above the average prime interest rate, with rebuttable presumption between the 1.5 – 2% brackets. Rebuttable presumption is another one of those fancy legal terms that simply means a borrower has the ability to raise a legal challenge but must prove the lender did not follow CFPB guidelines.

But why is that bad, isn’t that what NAHREP advocated for? Remember, lenders usually only lend in the safe harbor space. Considering that there are a large number of Latino borrowers that are already priced between 1.5 – 2% range, it could really spell trouble. Throw in the FHFA Capital Rule that could make loans for Latino borrowers even more expensive than they already are, and we might see more and more Latino borrowers pushed out of the QM lending space. We have to raise the safe harbor threshold up to 2% but we also need to make sure lenders are proving that these borrowers have the ability to repay the loan. So there’s a nuance here we gotta work on.

There’s some extra’s the CFPB wants comments on: some bad, some could be good.

Alternative solution to a pricing model, simply increase the DTI limit. The CFPB has suggested possibly increasing the DTI limit to between 45 – 48%. At NAHREP, we know that DTI is not only one of the worst predictors of risk but it’s also particularly not great for Latino borrowers. This proposal would also not solve for the problems with Appendix Q and the challenges of underwriting loans for self-employed borrowers.

Instead of using a pricing model alone, implementing a hybrid approach. This suggestion would include using both pricing and a DTI ratio limit. For example, a pricing model could be used for loans priced at below 1.5% above the average prime rate, and a DTI ratio could be used for loans above that threshold. This could be interesting solution; particularly given the potential problems associated with allowing lenders to determine risk on their own without strict documentation of income.

There is a lot we still need to understand when it comes to this new rule and how the FHFA Capital Rule will interact with these changes. NAHREP is in favor of creating a new entity to determine documentation guidelines for the industry in order to further ensure safe loans. We definitely want to avoid loans where borrowers just simply state their income and don’t show proof. We know how that goes. All of these are important considerations and the impact of these rules will determine whether or not Latinos reach a 50% homeownership rate any time soon.

Almost forgot… TAPENSE LA BOCA!

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.