2020 State of Hispanic Wealth Report

Celebrating NAHREP familia, cultura, politics, and grassroots action

October 8, 2020

Qué onda mi gente?!

I hope everyone had some time to relax after NAHREP at L’ATTITUDE! I’m still reeling off of Deepak Chopra’s meditation and Pitbull, two of my favorite sessions of the conference. And of course, I also hope you all had a chance to see our release of the 2020 State of Hispanic Wealth Report! If you missed it, you can still watch it on demand by visiting the conference hub for the next 30 days.

It is hard to believe but it has been 12 years since the last recession. Like for many of you, the Great Recession was one of those defining moments in my life. It is the reason I went into housing policy in the first place. Many of my family members in the Inland Empire of California lost their homes to foreclosures, eradicating the wealth they had built over the years. It was then that I made it my mission to be a part of the solution and ensure that we as a Latino community achieve power in this country by building our political muscle while simultaneously bridging the wealth gap. I hope that you can join me in that mission.

This year’s Hispanic Wealth Project has hit a new milestone: we’ve launched our first ever Hispanic Wealth Project National Survey released in this year’s State of Hispanic Wealth Report.

Why should you care?

If you’re a lender, the answer is easy. The definition of qualified mortgage defines the constraints around how you lend. Lenders mostly operate within what is called the “QM space.” These are the rules you live by. If you’re a real estate agent, well, this determines if your clients will get approved for a loan or not, if your deal will go through, or not. So trust me, you want to pay attention.

Key Findings: 2020 State of Hispanic Wealth Report

We hope that you will use this report not only as talking points, but as marching orders for what we need to do as a community to grow our wealth, and to help protect our community from the pandemic-induced recession.

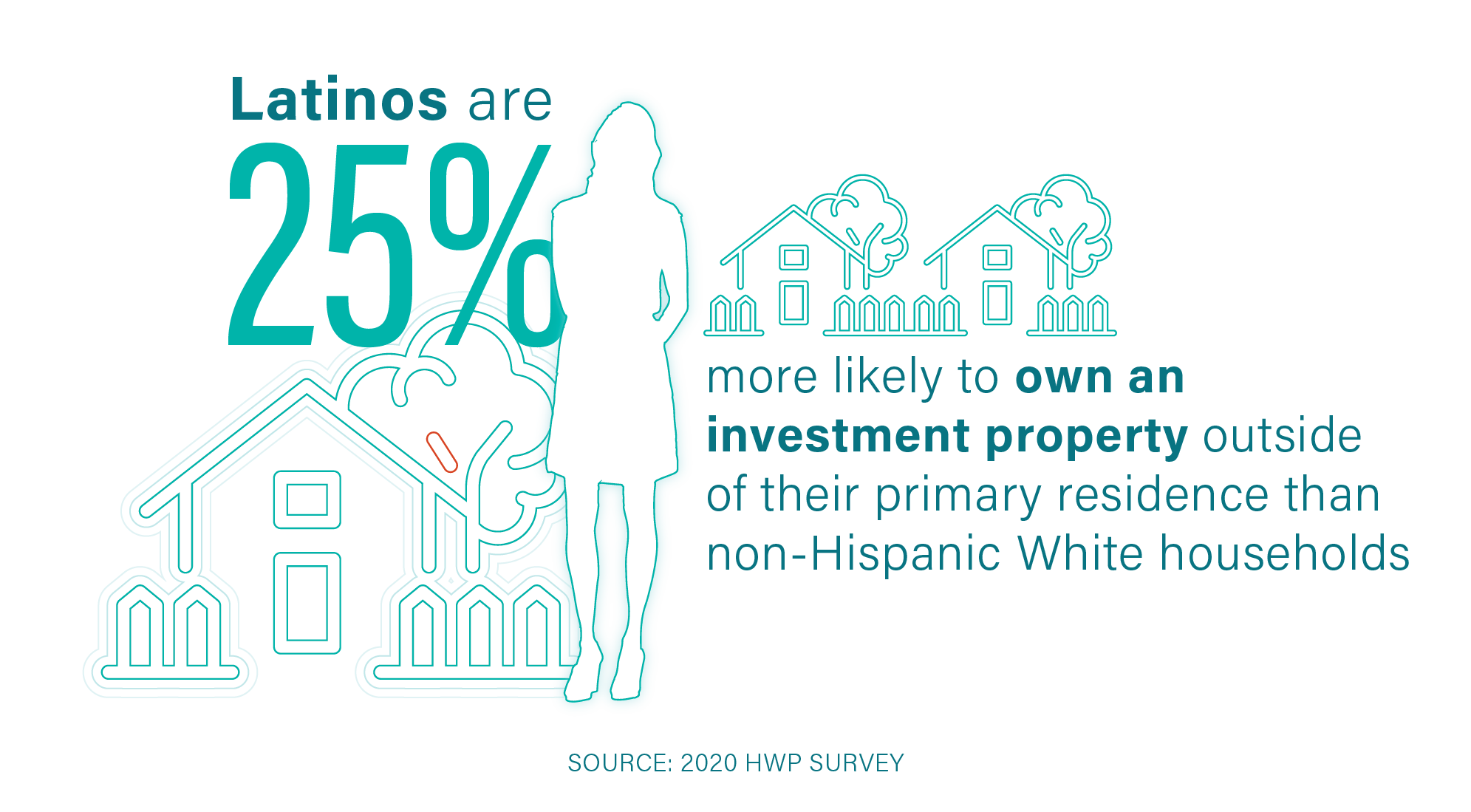

More likely to invest in real estate: Latinos are 25% more likely to own an investment property outside of their primary residence than non-Hispanic White households. And, 40% of Latinos that do not currently own a home plan to buy within the next 5 years.

This is an astounding finding because it highlights the Latino commitment to real estate. However, it also underscores the need to protect small landlords through the pandemic.

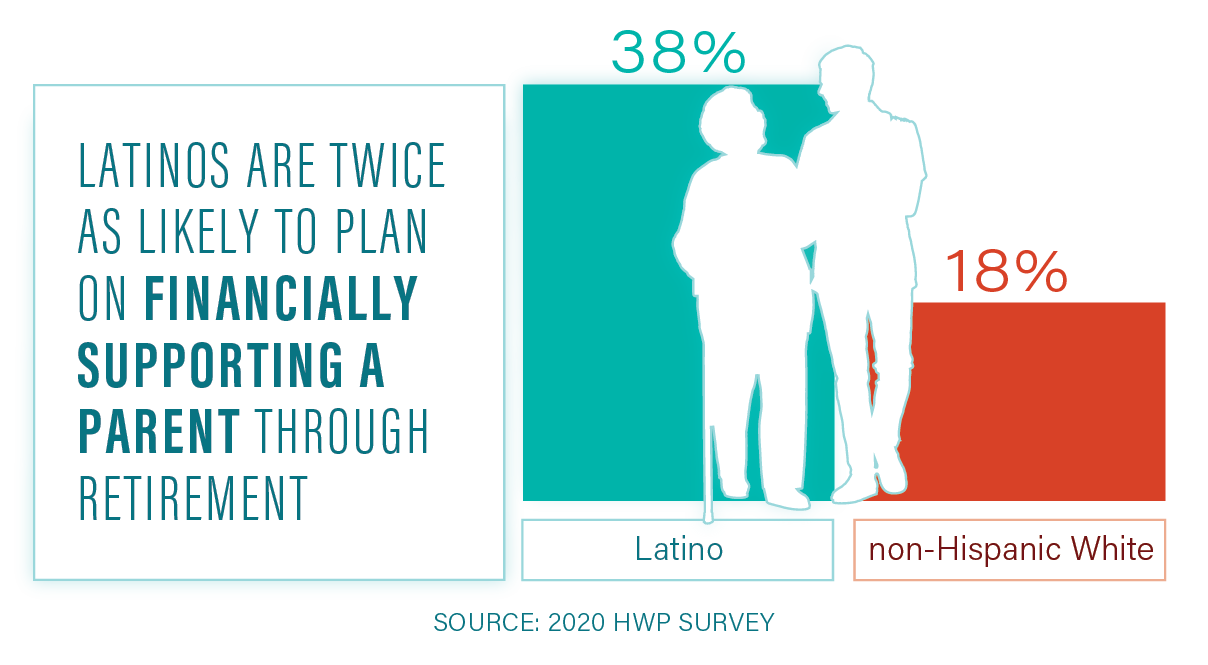

Taking care of elderly parents: More than any other population surveyed, Latinos were the most likely to report expecting to take care of an elderly parent in retirement.

According to the latest Survey of Consumer Finances, Latinos are the least likely to own retirement accounts. We must ensure that Latino families are able to support a payment shock of having to suddenly take care of an elderly parent in retirement.

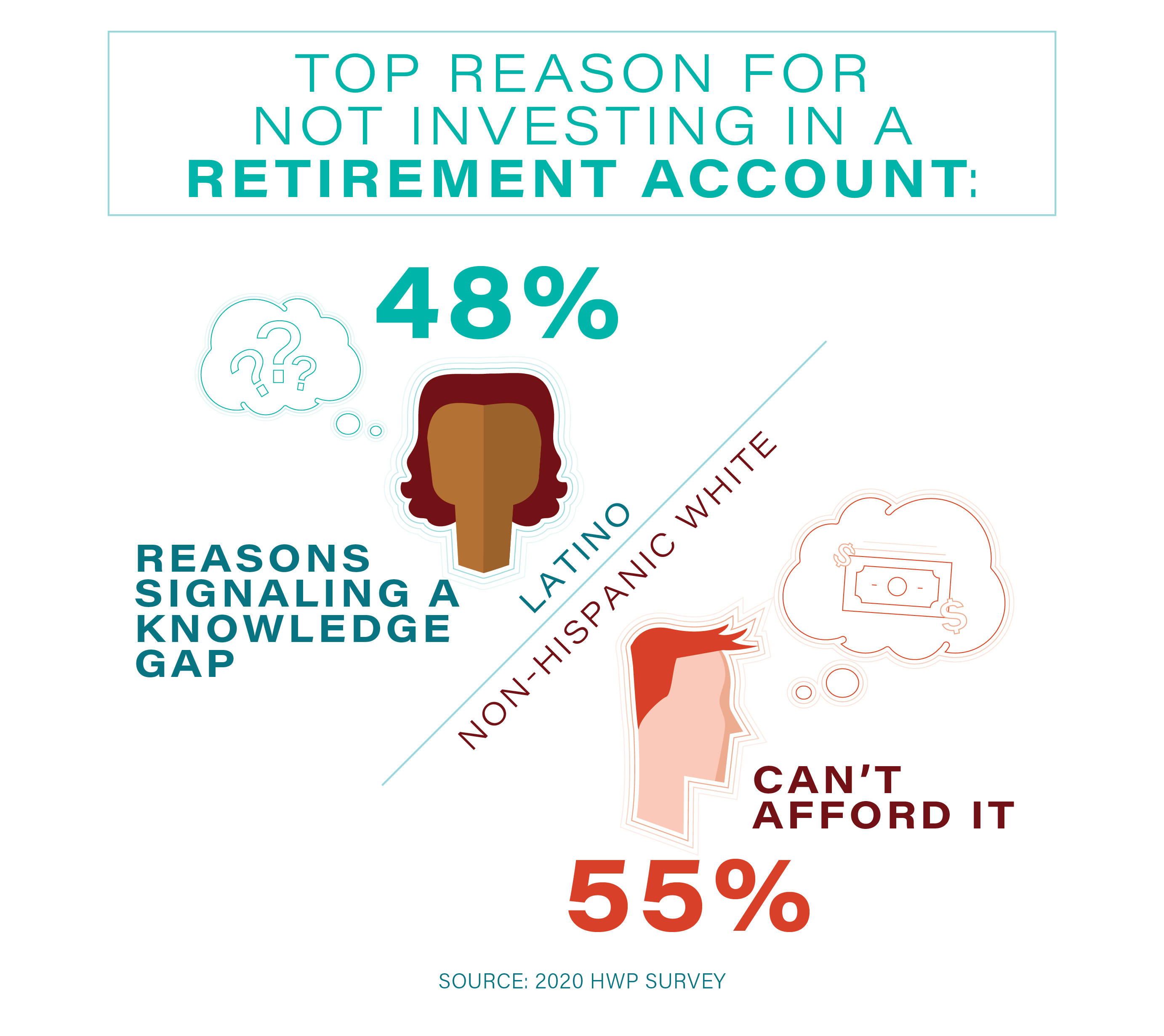

Latinos wary of stock market-based investments: Whereas over half of non-Hispanic White survey respondents that didn’t invest in retirement or brokerage accounts were more likely to cite not being able to afford those products as the primary reason for not investing in them, Latinos were more likely to respond that they didn’t think they were safe investments, they didn’t know how to invest in them or they had simply never heard of them.

Creating culturally relevant financial education for our Latino community will go a long way. However, it starts with YOU. How informed are you about stock-based investments? Do you have a retirement account?

Higher likelihood to have auto debt: Latinos are 41% more likely to have auto debt than non-Hispanic Whites. While cars are a critical tool to get to and from employment, they are not investments-they are a depreciating asset. This is critical to the NAHREP 10’s first principle of having a mature understanding of wealth.

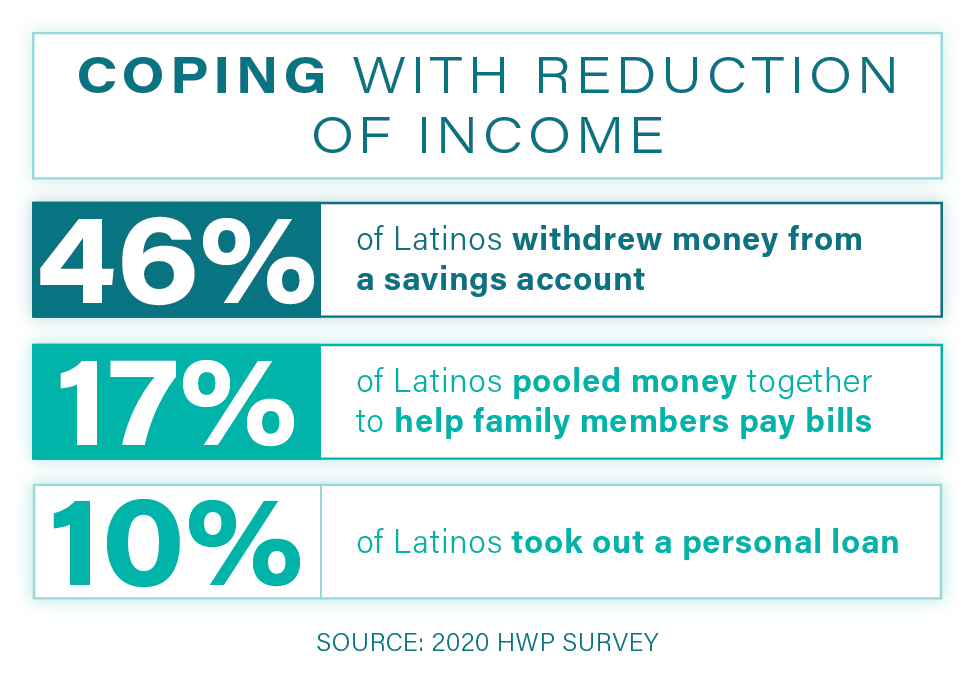

Drawing on savings: 59% of Latino households in the HWP survey reported an inability to save since the start of the pandemic. And, among those families, 46% have had to tap into at least half of their savings or more.

This is one of the most telling findings of how Latino families are reacting to the pandemic. Sharing your experiences of how all of you dealt and succeeded after the last recession is more important than ever.

To read the full report, can download here.

We will take the findings of this report and use it as our marching orders through the HWP over the next year. If you would like to be a part of these efforts by becoming a NAHREP 10 Certified Trainer, you can help us triple median household wealth for Latinos. Click here to apply.

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.