Coming Soon – 2021 State of Hispanic Wealth Report

Celebrating NAHREP familia, cultura, politics, and grassroots action

August 19, 2021

Qué onda mi gente?!

It’s State of Hispanic Wealth Report time!!! Every year, the Hispanic Wealth Project releases the State of Hispanic Wealth Report at NAHREP at L’ATTITUDE. This is the time of year when I try to clear my calendar and hunker down to write this thing. While I’m in the thick of analyzing the new data, I wanted to give you all a preview of what will be released next month. But first, let’s do a recap of the Hispanic Wealth Project.

What is the Hispanic Wealth Project about?

The Hispanic Wealth Project (HWP) was created back in 2014 after Latinos lost over two-thirds of their household wealth during the Great Recession. Many Latinos purchased homes at the peak of the housing bubble fueled in large part by easy access to sub-prime mortgage loans. Hispanics also have lagged the general population in terms of their investments in non-cash financial assets such as retirement accounts and value stocks. The combination of risky real estate investments and a lack of asset diversification left them especially vulnerable during the economic downturn. That was a tough time for Latinos. That’s why we set out to create this initiative, the Hispanic Wealth Project, with a goal of tripling median household wealth by 2024.

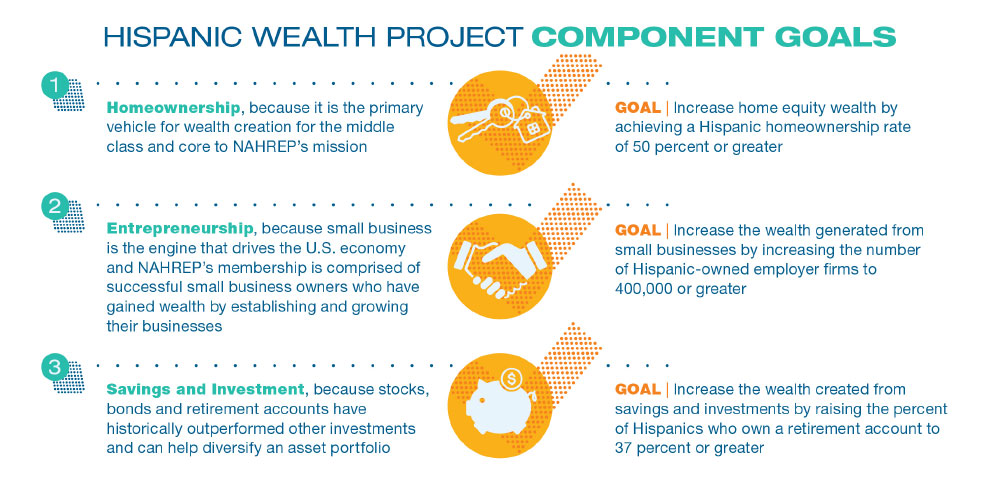

But how do we build wealth? The Hispanic Wealth Project developed a blueprint where we laid out 3 component goals to help us achieve our wealth goal focused on homeownership, entrepreneurship, and savings and investments. These component goals have evolved over time, but each is designed to create wealth in the Latino community.

Preview of the 2021 State of Hispanic Wealth Report

- Over the past 10 years, Latinos have increased their household wealth by 84.9%, by far the greatest increase of any demographic.

As the Survey of Consumer Finances data is only released every three years, net worth data is only available through 2019 so it does not account for the impact of the pandemic. However, Latino household wealth is trending upward and is on track to meet and even exceed our goal by 2024 – so that’s something to celebrate, apoco no? As of the most recent data from the Federal Reserve, Latinos now have a median household wealth of $36,050.

Homework: Do you know your net worth? Net worth is the value of all your assets minus the value of all your liabilities (or debt). If you haven’t sat down to calculate your net worth, there is no better time than now. Because you can’t improve what you don’t measure. - Latinos were 71.4% more likely than the general population to say they planned to start a business in the next 5 years.

The Hispanic Wealth Project has long been reporting that Latinos are driving entrepreneurial growth. Our survey data underscores that this reality is still the case. However, the pandemic hit a lot of Latino small businesses hard and many Latino-owned businesses closed down during the pandemic, particularly Latina-owned businesses. That being said, we know that Latinos are resilient. The HWP Survey data gives cause for optimism that Latinos will continue to drive entrepreneurial growth in the decades to come. - At 25.5%, Latinos have the lowest participation rate in retirement accounts of any demographic.

Between 2016 and 2019, the percentage of Latinos that own a retirement account actually went down! And for Latinos that do own a retirement account, the median value is the lowest across demographic groups. This is the area of most concern for the Hispanic Wealth Project and an area we intend to focus on most within our programs. Are you interested in being a part of the solution? Apply to become a NAHREP 10 Certified Trainer!

That’s all for now! To be the first to hear about the findings of the 2021 State of Hispanic Wealth Report, make sure to attend the report release session at NAHREP at L’ATTITUDE. If you haven’t registered, make sure you do so today. We have a jammed-packed program of speakers and it will be amazing to see all of you again. Un abrazo!

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.