Insights from the SHHR: Multigenerational Living Among Latinos

Celebrating NAHREP familia, cultura, politics, and grassroots action

March, 2023

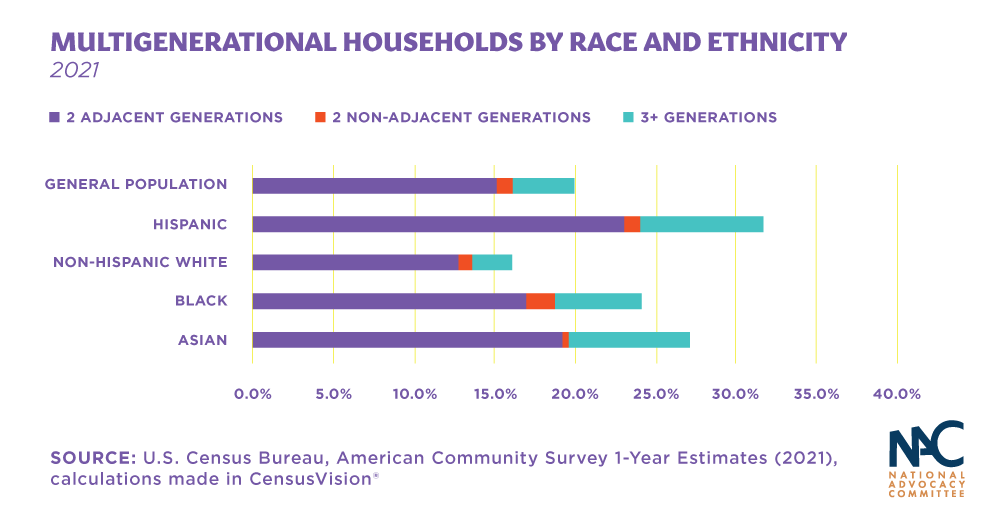

La familia is at the crux of multigenerational living among Latino households. Many of us, or someone we know, live with a grandparent, an aunt or uncle, etc. This isn’t surprising. We know anecdotally that Latinos are more likely to live in a multigenerational household compared to other demographic groups, but what does the data actually show? Insights from the State of Hispanic Homeownership Report found that Latinos are among the most likely demographic to live in a multigenerational household, a trend that is increasing as housing affordability worsens. Multigenerational living allows for the pooling of economic resources, making homeownership more attainable in a market impacted by affordability challenges. However, it can also make homeownership more challenging.

Latinos are among the most likely to live in multigenerational household

The 2022 State of Hispanic Homeownership Report found that almost one-third, or 31.7 percent, of Latino households are multigenerational. Latinos continue to be among the most likely demographic gruops to live in multigenerational households at just over 5.8 million households. This trend isn’t surprising and housing costs have led to an increase in multigenerational living in recent years. This is particularly true among two adjacent adult generations, such as parents and their adult children. Since 2017, there has been an increase of more than 800,000 Latino multigenerational households that consist of two adjacent adult generations living together.

In addition, many young Latinos are purchasing homes to live in with their parents. The vast majority include two adjacent adult generations, such as parents living with their adult children. This trend may be increasing. In 2022, 7 out of 25 participants in NAHREP’s Top Real Estate Practitioners Study indicated an increase in multigenerational buyers last year alone, while 19 out of 25 reported an increase in co-borrowing, especially among family members. Pero que significa esto?

Even though multigenerational living allows individuals to pool various incomes together, it can make it more difficult for these borrowers to qualify for a mortgage. Moreover, multigenerational families tend to look for larger homes that can accommodate an accessory dwelling unit (ADU), a mother-in-law suite, etc., to accommodate their family members – which may be more expensive than a traditional starter home. Additionally, this could mean relocating further away to find homes with a larger square footage and ample living space.

As a policy priority, NAHREP recommends expanding underwriting to allow for the inclusion of boarder income or future income derived from secondary units. Additionally, regulations should be streamlined to allow financing for the construction of ADUs, granny flats, in-law units, backyard cottages, and other secondary units that would make multigenerational living more attainable.

The Espinoza Family: A story about multigenerational living

NAHREP’s very own Imelda Manzo shared her experience working with multigenerational buyers in Southern California. The family struggled for months looking for a home in Santa Ana, California, that could accommodate their multigenerational household. According to data from the State of Hispanic Homeownership Report, Santa Ana is among the least affordable markets for Latinos in 2022, with a gap of $72,700 when comparing the market’s median Hispanic household income and the income needed to be able to afford the median priced home. While home price appreciation cooled in the latter part of 2022 as interest rates rose, it wasn’t enough for the Espinozas, especially given the squeeze interest rates have on purchasing power. Manzo shared the family continued to face several counteroffers, waived inspections and appraisal contingencies, and competing offers well over asking. At the time of this story’s publication, the Espinoza family decided to keep waiting.

But there’s good news! This month, in March of 2023, the Espinozas were finally able to purchase their first home. Despite challenges, they showed the resiliency and persistence that the Latino community is known for. Real Estate practitioners in NAHREP studies frequently cite the willingness to make sacrifices and get creative as a characteristic that distinguishes Latinos from other demographics. In this year’s report, when asked if affordability challenges created insurmountable barriers for their Latino clients in 2022, every single participant in NAHREP’s Top Real Estate Practitioners Study said that despite challenges, most of their Latino clients found a way to buy a home.

Join the NAC Blog Mailing List

SubscribeAbout NAHREP’s National Advocacy Committee

The National Association of Hispanic Real Estate Professionals® (NAHREP®) advocates on behalf of its network of 50,000 real estate professionals and Hispanic homeowners nationwide. NAHREP focuses on national and state legislative issues that are critical to its mission: to advance sustainable Hispanic homeownership.

NAHREP firmly believes every individual who desires to become a homeowner and can sustain a mortgage should be granted access to a piece of the American Dream. To that end, we are focused on three main priorities: Housing Inventory, Access to Credit, and Immigration. Visit our website to read more about NAHREP’s policy priorities and to get involved.