The National Association of Hispanic Real Estate Professionals® (NAHREP®) advocates on behalf of its 40,000 members and Hispanic homeowners nationwide. NAHREP focuses on national and state legislative issues that are critical to its mission: to advance sustainable Hispanic homeownership.

NAHREP joins a coalition to urge Congress to permanently extend the Mortgage Insurance Premium Tax Deduction

NAHREP joined a coalition to urge asking the Senate to make the current mortgage insurance premium tax deductions permanent and increase its income phaseout. For years, mortgage insurance premiums have been tax deductible and subject to an income phaseout for taxpayers with adjusted gross incomes (AGI) over $100,000 (or $50,000 if single or married, filing separately). Millions of low- and moderate-income homeowners have benefited from the tax code. However, the provision’s temporary nature and low income phaseout could create a burden in allowing additional families to claim the deduction. The AGI cap has not changed since 2007, when the deduction first took effect.

NAHREP offers recommendations for proposed ruling on DACA

NAHREP submitted a comment letter to the Department of Homeland Security (DHS) on November 29, 2021, encouraging a reevaluation of the proposed changes to the Deferred Action for Childhood Arrivals (DACA) program. While we are heartened to see DHS make efforts to preserve and strengthen DACA, we offer recommendations that will bolster the program even further. We encourage DHS to secure work authorization for DACA recipients, recognize them for their economic contributions during the COVID-19 pandemic, and update DACA eligibility standards.

NAHREP urges Congress to refrain from utilizing Fannie Mae and Freddie Mac (“the GSEs”) guarantee fees (“g-fees”) as a source of funding offsets in Infrastructure package

NAHREP joined a coalition of institutions that span the entire housing finance ecosystem to ask Congress to refrain from using Fannie Mae and Freddie Mac (“the GSEs”) guarantee fees (“g-fees”) as a source of funding offsets in Infrastructure package. G-fees should only be used as originally intended: as a critical risk management tool to protect against potential mortgage credit losses and to support the GSEs’ charter duties.

Given today’s housing affordability and supply constraints, lawmakers must avoid taking any steps that may exacerbate affordability challenges, which could in turn have negative consequences for the broader economy. The unintended effects of any proposed g-fee increase or extension will be to raise the cost of homeownership for all Americans, and low- to moderate-income and underserved individuals in particular.

How are you contributing to sustainable Hispanic homeownership?

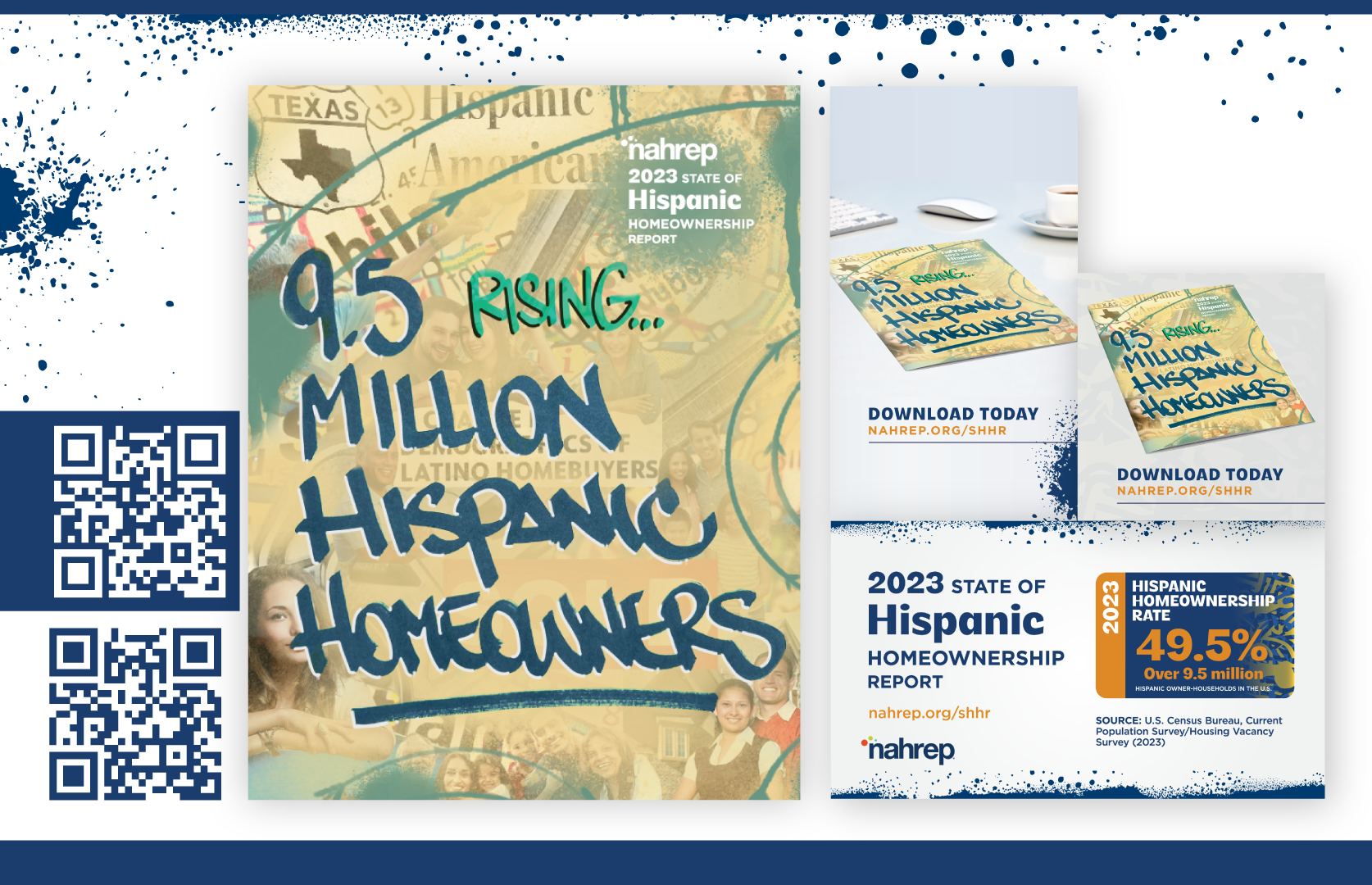

Download our State of Hispanic Homeownership marketing toolkit and spread the word to empower Latino homebuyers! Includes social media graphics and more.

Download toolkit

A NAHREP Original Short Film

Immigrants play in the future of the health and prosperity of the U.S. economy. NAHREP can set an example not only for the Latino community but for the entire country. As a bipartisan group of business professionals, we can speak about issues such as immigration in a very pragmatic and unemotional way.

2022 State of Hispanic Homeownership Report

This year’s State of Hispanic Homeownership Report tells a story. In addition to the data and research analyzing homeownership attainment among Latinos in the U.S., NAHREP commissioned photographer Adriel Salazar to capture images of real families that purchased a home in Houston, Texas last year. These photos capture a pivotal moment in time and humanize the Latino homeownership journey. NAHREP chose to feature families in Houston because the city was the third highest-ranking market that added the greatest number of new Latino homeowners over the last two years. Overall, Texas continues to be home to the nation’s top opportunity markets for new Latino homebuyers.

Insights from the SHHR: Multigenerational Living Among Latinos

La familia is at the crux of multigenerational living among Latino households. Many of us, or someone we know, live with a grandparent, an aunt or uncle, etc. This isn’t surprising. We know anecdotally that Latinos are more likely to live in a multigenerational household compared to other demographic groups, but what does the data actually show? Insights from the State of Hispanic Homeownership Report found that Latinos are among the most likely demographic to live in a multigenerational household, a trend that is increasing as housing affordability worsens. Multigenerational living allows for the pooling of economic resources, making homeownership more attainable in a market impacted by affordability challenges. However, it can also make homeownership more challenging.

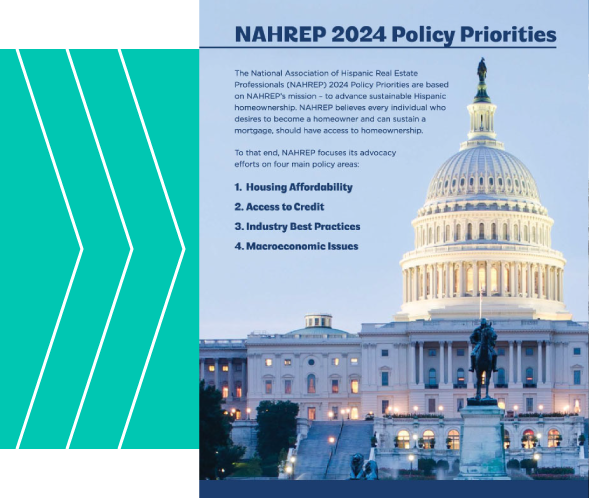

NAHREP Members Take On Capitol Hill to Share the 2023 Policy Priorities

Carrying on a 20-year-long tradition, nearly 200 NAHREP members attended meetings with 45 Congressional offices on Capitol Hill as part of NAHREP’s Homeownership & Wealth Building Conference annual fly-in. It was wonderful to see so many passionate and driven professionals come together for a common goal – to advocate on behalf of NAHREP’s mission, to advance sustainable Hispanic homeownership. During these meetings, our members shared NAHREP’s 2022 State of Hispanic Homeownership Report and the newly released policy priorities for this year.