NAC Blog: Playing Offense and Defense as We Champion Hispanic Homeownership

Celebrating NAHREP familia, cultura, politics, and grassroots action

Que onda mi gente?!

Last week we released our 2019 State of Hispanic Homeownership Report where we celebrated five consecutive years of Hispanic homeownership growth. Latinos are the youngest and fastest growing population, and have the highest labor force participation and household formation rates. These characteristics coupled with an overwhelming desire for homeownership propelled Latinos to help lift the nation out of a housing recession once. We believe that it is these same factors that will lead Latinos do so once again in a post-pandemic economy.

However, there are two plays to cement those efforts.

First, we play defense. We have got to help keep Latinos in their home.

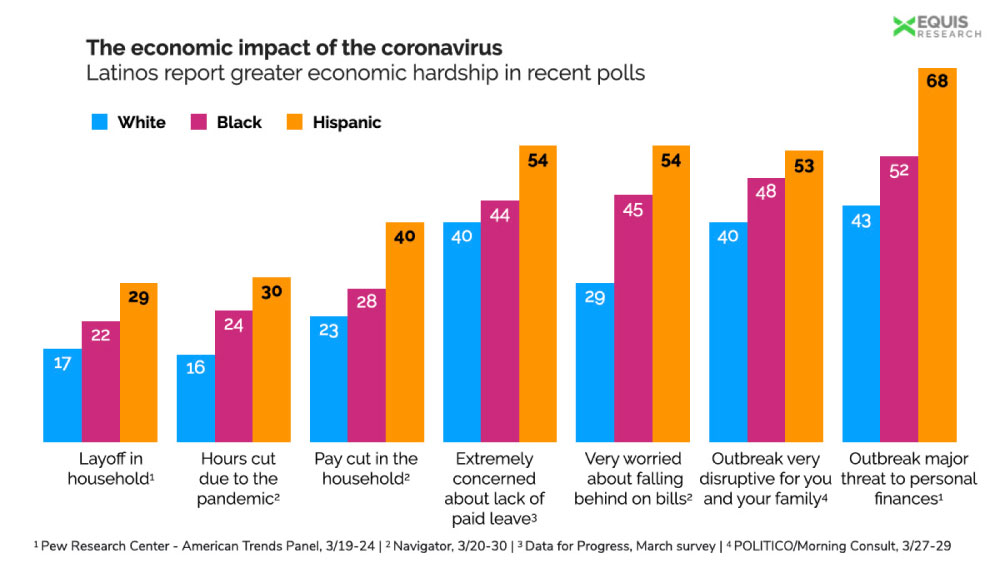

Latinos are disproportionately reporting greater economic hardship because of the COVID-19 pandemic. With the high concentration of Latinos employed in the service, hospitality and restaurant industries, those economic sectors experiencing some of the greatest number of layoffs, we can expect that many Latino families will have a hard time paying their mortgage in the coming months. It is imperative that we keep educating Latino families on their options. For a Spanish language discussion to share with your clients on forbearance options available under the CARES Act, click here.

Additionally, we must keep putting pressure on Congress to provide liquidity to the mortgage servicing market so that Latino families who need it, can take advantage of forbearance options to help keep them in their home. This is so important. Please stay posted as we release our next list of priorities for Congress as they debate the next Coronavirus stimulus bill.

At the same time, we need to play offense and change the narrative.

It is important to make it clear to lenders and policy makers that the overlays and tightening of credit in the market today will only handicap the nation’s ability to rebound from this economic crisis.

Latinos are driving homeownership growth in America. For the past 10 years, Latinos have accounted for 51.6 percent of the homeownership growth. With such a critical role in the future of the housing market, it is important to understand the credit characteristics of Latino homebuyers:

According to our 2019 State of Hispanic Homeownership Report, the following is the profile of the median Hispanic homebuyer:

- 684 credit score

- 3.5% down payment

- 42% debt-to-income ratio (with more than 1/3 over 45%)

However, the overlays currently seen in the market asking for upwards of a 700 credit score, higher down payments and lower DTIs, will mean that the Latino cohort will be almost cut out of the market. To quote Laurie Goodman from the Urban Institute:

“In the context of the current COVID-19 reality, and reading through this report, I became concerned that even though home prices will level off or drop momentarily, many with a job will be unable to take advantage as lenders have temporarily tightened their lending standards asking for higher credit scores and lower DTI ratios. Hopefully the credit tightening will be very short lived.”

Please join me in the coming months in making this point very clear to policy makers and lenders: if we want the market to rebound… you can’t exclude the cohort leading homeownership growth.

Paycheck Protection Program

Many of you have been asking how to apply for the Paycheck Protection Program under the CARES Act. Please click here to hear directly from NAHREP 2020 President Sara Rodriguez and Elizabeth Dobers from BBVA, and myself, as we break down the ins and outs of applying for a PPP loan.

Last days to submit survey response!

As we gear up for the next stimulus battle, we need to hear from you more than ever. Please take 2 minutes to fill out this survey as we find ways to better serve you. Click here, if you haven’t already.

We have to keep educating our community. We have to keep innovating. We have to keep helping each other so that we can help more Latinos weather this storm. If anyone has the passion and resilience to do that, it is the Latino community in America.

Un abrazo a todos!

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.