NAHREP Landlord Survey

The National Association of Hispanic Real Estate Professionals (NAHREP) and UC Berkeley’s Terner Center for Housing Innovation partnered to survey NAHREP’s membership to gauge the experiences of small “mom and pop” landlords during the pandemic. The responses indicate great concern as many of the CARES Act’s support expire, and the need for targeted assistance grows. The survey was administered between June 29, 2020 and July 9, 2020 and received 620 responses, of which 380 came from owners or managers of rental properties. Download the fact sheet for an analysis of those responses.

How Are Smaller Landlords Weathering the COVID-19 Pandemic?

FACTSHEET

July 2020

The COVID-19 pandemic has worsened in the U.S. in recent weeks, with confirmed cases of the virus reaching 4 million and continuing to climb. The nation has now seen 18 consecutive weeks of unemployment claims that have been more than twice the number reported during the worst week of the Great Recession. Renters have been disproportionately impacted by job losses given that they are more likely to be employed in industries hit hardest by the effects of stay-at-home orders. This has had a profound effect not only on tenants but also on landlords, particularly smaller landlords who aren't as capitalized as large rental properties. The National Association of Hispanic Real Estate Professionals and UC Berkeley’s Terner Center for Housing Innovation partnered to circulate a brief online survey to NAHREP’s membership to better understand their experiences so far during the pandemic, what they anticipate in the coming months as the CARES Act’s supports are set to expire, and the need for targeted assistance to landlords who are facing rental shortfalls during the pandemic.

The survey was administered between June 29, 2020 and July 9, 2020 and received 620 responses, of which 380 came from owners or managers of rental properties. An analysis of those responses finds:

Among survey respondents, 4 out of 5 own or manage fewer than 20 units

- Of the 380 property owners or managers who responded to the survey:

- 58% own or manage 1 to 4 units

- 25% own or manage 5 to 19 units

- While respondents have properties in 31 different states and territories, roughly half of the ZIP codes reported fall in California (22%), Texas (15%), and Illinois (12%)

Most of these landlords (67%) expect to derive at least one-fourth of their retirement income from their rental properties

- More than one-third expect to get the majority of their retirement income from these properties

- Those managing 5 to 19 units were most likely to see their properties as a source of retirement income. Of those landlords, 87% expect to get at least one-fourth of their retirement income from their rental properties and most (52%) expect to get more than half

The majority of respondents reported that rent collections are down compared to the prior quarter, and 1 in 4 have already borrowed funds to cover operating costs

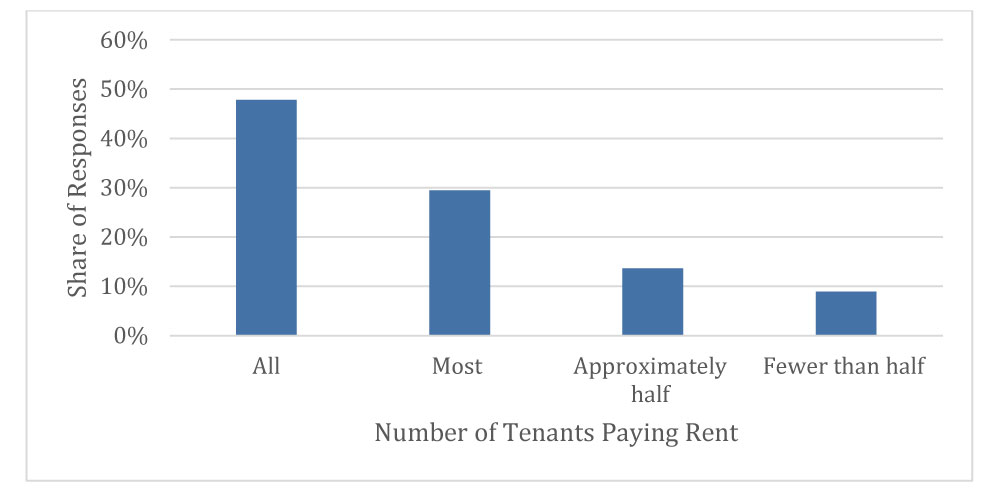

- 52% of landlords in the survey had at least one tenant not pay rent last month (Figure 1)

- Roughly 1 in 10 respondents said that fewer than half of their tenants paid rent last month, and those responses came almost exclusively from small landlords with fewer than 20 units

Figure 1. Landlords Reporting on the Number of Tenants Who Paid Rent Last Month

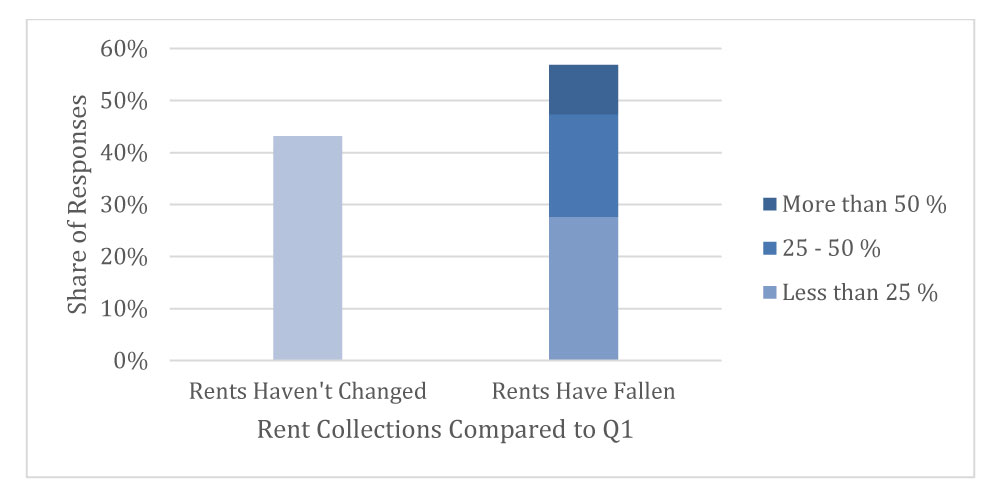

- 57% of landlords reported that rent collections are down from the first quarter, with 30% of respondents saying they are down more than 25% (Figure 2)

Figure 2. Reported Rent Decreases Compared to the First Quarter

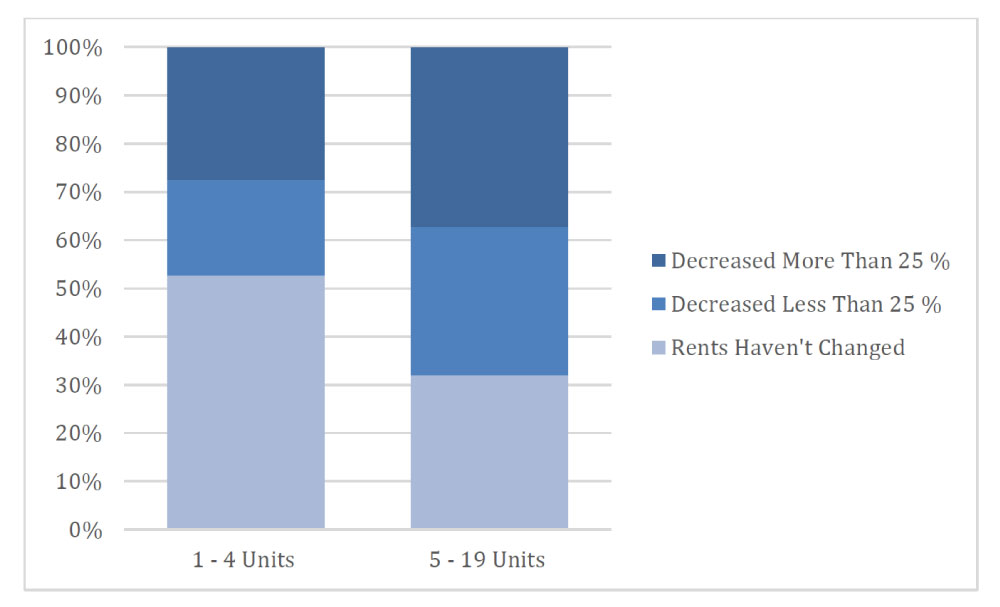

- Some variation emerges among smaller landlords, with owners and managers of 5 to 19-unit buildings more likely to report decreases in collections and steeper drops compared to the first quarter (Figure 3)

Figure 3. Changes in Rent Collections by Landlord Size

- One-quarter of all respondents had to borrow funds to cover shortfalls in operating costs. The vast majority of those landlords (84%) owned or managed fewer than 20 units

Only 3 out of 5 respondents expressed some level of confidence in being able to cover their costs over the next three months, and 4 out of 5 said they would be interested in a government loan program to help landlords

- Only 61% of respondents expressed confidence in being able to cover their operating costs over the next quarter

- 83% of respondents expressed interest in a government loan program to help landlords, with half saying they were very interested

- Among already-interested respondents, approaching 90% said that features such as low interest (86%) and no repayment for 10 years (89%) would increase their interest in such a program. And most already-interested respondents also signaled interest in the program if it required documentation of COVID-related impacts (65%) or eviction protections (60%)

- For respondents who said they were uninterested in a government loan program, the majority (55%) said low interest rates and no repayment for 10 years would boost their interest. And most said that documentation and eviction protections would diminish interest (61% and 56%, respectively)