National Advocacy Committee Blog: The MBA, Keith Urban & The Patch

Celebrating NAHREP familia, cultura, politics, and grassroots action

Que onda mi gente?

I had the pleasure of spending last week at the Mortgage Bankers Association Conference in the beautiful city of Austin, Texas. Aside from the insightful information I learned at the conference, my personal highlight was eating at a new restaurant called Suerte. I must say, I was impressed by Executive Chef Fermín Nuñez. I saw that the restaurant was featured as one of the 18 best new restaurants in the country by Eater last year, and I can see why.

I’ve heard from a lot of people say that they don’t like to eat “fancy Mexican food.” The argument is, why spend the money when you can get Mexican food that tastes homemade at a hole in the wall. I get that. However, I’m bothered by what types of cuisines we consider ok to be “fancy.” Think about the psychological impact on how we monetize the cuisines of certain communities. If you compare it to Italian food, Italian food is usually considered “fancy date night food” and people pay accordingly. But, there’s this notion where people don’t think it’s worth paying for “fancy Mexican.” Personally, I get excited when chefs like Fermín Nuñez offer innovative takes on traditional Mexican dishes in beautiful ambiences.

Anyways, suffice to say I couldn’t stop thinking about that meal, even while I was at the MBA’s Keith Urban Concert. By the way, and I kid you not, there was a ballroom full of people listening to Keith Urban and NO ONE was dancing! Not even a hand moving, or a little swaying! People were standing and just staring at Keith Urban! As a Latina, I did not understand, how, or what was happening. I even asked Steve O’Connor from the MBA and his response was, “I’m sorry. This isn’t a NAHREP conference!” I guess not.

So what’s the latest in DC?

The QM Patch is Going to Expire

If any of you attended Policy Conference this year, you might have heard of us talking about “the patch.” I know that sounds like a nicotine patch or something pirates wear to hide their scars, but this both boring sounding and weird sounding “QM patch” might be the single most consequential piece of policy that could impact your business and Hispanic homeownership in the coming years. This is why we keep talking about it. Expect NAHREP to be very involved in this debate for the next few years.

So what is this thing?

The Consumer Financial Protection Bureau (CFPB) created a series of rules after that financial crisis that determined the criteria for mortgage loans to be considered a “Qualified Mortgage.” Because of the fear of getting sued, financial institutions ended up almost exclusively issuing loans that fell within the QM guidelines. It’s like the USDA sticker on meat. As a consumer, would you actually eat meat without that sticker?

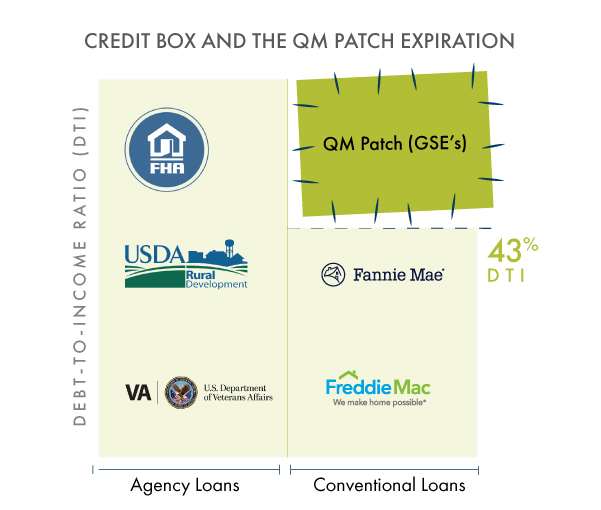

The issue is that the lines drawn on what gets that QM stamp has a big impact on Latino borrowers who may have higher than average debt-to-income ratios. The CFPB was going to draw the line between QM and non- QM at loans with a DTI of 43% and below. During this time, we got lucky because they also issued “the patch” which allowed loans qualified by the GSE’s to also get that QM stamp, regardless of their debt-to-income ratio. The “patch” was a temporary fix but it allowed for more flexibility and for Latinos with higher DTI loans to have access to the conventional market. This “patch,” is set to expire in 2021, despite many in the industry assuming that the CFPB would extend it permanently. The CFPB, however, announced earlier this year that they planned on letting the patch expire. Not all of this is bad news, if and only if, they replace the “patch” with something that doesn’t restrict access to credit, and fixes the problems with lending to self-employed borrowers in the process.

This is a big deal because 1 in 5 GSE-backed mortgages in 2017 had DTI ratios over 43 percent and Latinos are 38 percent more likely to have a high DTI loan.

To read the letter we submitted on behalf of NAHREP click here.

We still have time. We will have two more opportunities to comment:

- After the CFPB releases its proposed rulemaking.

- After the CFPB releases the Final Rule

Let’s start getting ready by collecting stories of credit worthy individuals who might have DTIs above 43%. Go to https://nahrep.org/engage/ to share your stories.

No other demographic will be more impacted. We need to be prepared to answer back. This is where we put the power of our organization and raise our voice like what we are: the driver of housing demand in the U.S. In the words of our National Advocacy Committee, when #NAHREPKNOCKS you answer.

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.