NAC Blog: Lumber shortages fuel the housing inventory crisis

Celebrating NAHREP familia, cultura, politics, and grassroots action

June 10, 2021

Qué onda mi gente?!

What is more valuable than gold right now and is adding fire to our housing inventory crisis? You got it: LUMBER!

First, we were out of toilet paper, then we couldn’t find any disinfectant wipes anywhere, and now, lumber “se va de Home Depot and Lowes como pan caliente.” I know many of you have seen the memes or the TikToks by now highlighting just how crazy this whole “run on lumber” has gotten, so I thought I would give you a quick timeline of how we got here:

Great Recession: Housing crisis hits the construction industry hard.

2008-2019: The lumber industry struggles to recover from the recession. In the U.S. and Canada, sawmills (where they convert the cut trees into the panels of wood we use for building homes), either closed or cut down on their operations.

2019: This was a pretty bad year for the lumber industry. Tariffs were placed on imports from Canada (where a lot of our lumber comes from), wildfires and beetle infestations in British Columbia Canada further reduced supply, and issues with the rails that are used to transport lumber to the U.S. caused a bunch of delays.

March of 2020: Everyone was waiting for a recession, everyone predicted an economic “correction.” Admit it, you did too. So, when the pandemic hit and the stock market went crashing down, the lumber industry said, “this is it.” Therefore, they cut back on their operations and the lumber industry prepared for a bad year.

Instead, the country went crazy over DIY projects and making home renovations during the pandemic, and of course: new home constructions couldn’t be built fast enough to meet demand.

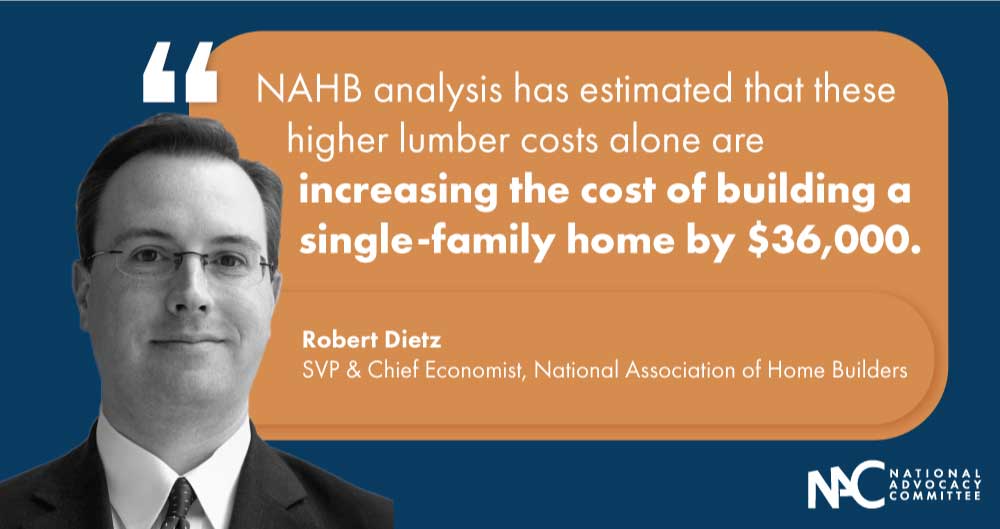

In order to discuss how this lumber-craze is impacting the housing industry, we invited our good friend Dr. Robert Dietz, SVP and Chief Economists for the National Association of Home Builders (NAHB), to help break it down for us.

Q: So break it down for us. What are we looking at? What is the current cost of lumber?

Dr. Dietz: As of the end of May, the price of lumber stood near an all-time high of approximately $1,500 per thousand board feet. Since mid-April 2020, softwood lumber prices have increased more than 320%, from a starting and more normalized price of $350 per thousand board feet. The reason for this historic acceleration of lumber prices is basic economics: strong demand from builders and remodelers and insufficient supply. In particular, while single-family construction increased 12% last year, and the remodeling market was up 7%, domestic sawmill output only increased a little more than 3%. In addition, imports of Canadian softwood lumber (30% of our national supply) were lower by more than 10% when comparing 2016 trade levels and 2020 totals. This is a period when tariffs were placed on such imports.

Moreover, as with the broader economy, it’s not just lumber that’s limiting additional inventory. A broad set of building materials and goods are in short supply, whether it be appliances, trusses, steel fasteners, windows/doors, cooper, and more. In fact, on an aggregate basis, a NAHB survey found that for a typical new home, material pricing on a per home basis had increased 26% over the last year. In addition, construction times are being extended due to delivery delays.

Consequently, it costs more and is taking longer to build homes, apartments and complete remodeling projects.

Q: Why should we care about lumber-mania? How is the cost of lumber making our housing inventory crisis worse?

Dr. Dietz: Everyone in housing knows we have a deficit of housing inventory in the U.S. For example, a Freddie Mac analysis found that the country is short more than 3 million homes relative to demographic need. Higher material costs, including lumber, are making it that much harder to close this deficit, particularly during this time of near historically low-interest rates. NAHB analysis has estimated that these higher lumber costs alone are increasing the cost of building a single-family home by $36,000 and raising the cost of a typical apartment by about $13,000 ($120 a month in rent). And of course, higher costs tend to price out first-time and first-generation buyers from the market first and increase already harmful rent burdens.

Q: What can NAHREP members do?

Dr. Dietz: All housing stakeholders have an interest in encouraging policymakers to take actions that will lead to additional housing supply. So in addition to policies that would increase the construction labor force and enacting zoning reform rules that would allow for additional land development, NAHREP members can also be engaged with their representatives to find ways to increase domestic production of building materials, including softwood lumber, as well as encouraging the Biden Administration to reduce tariffs on imported Canadian softwood lumber and achieve a new softwood lumber agreement.

Unfortunately, our forecast now sees these supply-side material challenges persisting into 2022, which will result in higher housing costs nationwide. Fortunately, the demographics for housing demand are and will remain quite strong given the years of underbuilding over the last decade.

Let’s add this to our list of things we advocate for mi gente. Also, I challenge any of you to do a TikTok or a reel on this. A drink is on me at NAHREP @ L’ATTITUDE for whoever makes the best one.

About Noerena Limón

Noerena Limón is NAHREP’s Executive Vice President of Public Policy and Industry Relations. Noerena heads the organization’s policy and advocacy efforts on issues ranging from homeownership, housing inventory, credit access and immigration.

Prior to joining NAHREP, Noerena spent six years at the Consumer Financial Protection Bureau (CFPB) and served as a political appointee under President Obama in the White House Office of Political Affairs.